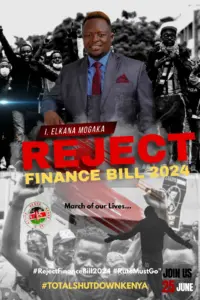

By Elkana Mogaka

If the Finance Bill, 2024 passes as-is, we will witness the wave of tax hikes in less than 2 years into President Ruto’s 5-year term. The first wave came courtesy of the Finance Act, 2023.

Reluctantly, on Tuesday 18th June, Parliament caved to public pressure, deleting some of the more contentious clauses in the Bill:

– Excise duty on Mpesa, etc and internet services. The tax will remain at 15% and not rise to 20%.

– 16% VAT on bread scrapped. Though it is unclear whether bread will be zero-rated. If bread is not zero-rated, manufacturers will pass on the tax to consumers.

– 2.5% Motor vehicle tax removed. It would have had adverse effects on ownership and running of motor vehicle both for personal and corporate use.

– Etims for farmers. Farmers with income of less than 1 million no longer required to register on e-tims.

– Allowing KRA to snoop on Kenyans. Bill would have seen an amendment to Data Protection Act to exempt and allow KRA to process citizens data for taxation purposes.

Even with those clauses removed, the Bill makes its way to the Committee Stage, and it remains punitive with these provisions:

- Digital Content Withholding Tax – Bill proposes an amendment to the Income Tax Act, expanding the definition of digital content monetization.

Withholding tax on digital content was already introduced in the Finance Act, 2023. The tax was set at 5% for Kenyan residents and 20% for non-residents.

This amendment will expand the definition of creative works to include: “the creation or sharing of digital content or any other material not exempted under the Income Tax Act (ITA).”

The aim is to capture more content posted or made by content creators. The rate of taxation itself has not increased, it remains at 5% for locals, however more and more content creators will be covered and thus taxed for what they post and/or create. Together with the eco levy on imported transmission equipment, digital equipment, it will see production, studio costs go up.

- Replacing the Digital Service Tax (DST) with Significant Economic Presence Tax (SEPT) – The bill seeks to repeal the digital service tax regime and replace it with the Significant Economic Presence Tax.

This tax is imposed on foreigners or non-residents who make money from the provision of services through a digital marketplace in Kenya. It follows a trend by countries such as Nigeria and India in taxing non-residents and foreigners who derive such income locally.

The tax is imposed on the taxable profits of the non-resident at a rate of 20%. The deemed taxable profit shall then be taxed at 30%.

- Withholding tax obligation – to the owner or operator of a digital marketplace.

The tax is upon an owner or operator of a digital marketplace or platform through which payments in respect of digital content monetization, goods, property, or services are made or facilitated.

This will affect online taxi services such as Uber, Bolt etc. The withholding tax rates shall be 5% for resident payments and 20% for non-resident payments.

Research conducted by Deloitte anticipates an administrative burden to owners or operators of digital marketplaces or platforms, as they will be required to comply with the deduction and remittance of withholding tax whenever a payment is made or facilitated through their platforms.

Non-residential owners and operators of these digital marketplaces will need to be registered in Kenya to be able to comply with these new tax requirements.

- Eco-levy – It had been scrapped last Tuesday for locally manufactured products including sanitary towels, diapers, phones, computers, tyres and motorcycles.

However, it is retained for diapers, phones, digital transmission equipment and computers if imported. Since most smartphones and computers are imported, purchasing costs will increase.

- VAT on petroleum products up from 8% to 16% – This will see fuel prices at the pump going up. Cost of Diesel used to run generators will also experience a price hike, in turn affecting electricity production and costs.

Overall, costs of production of locally manufactured goods to increase with the fuel levy. This steep increase is expected to hinder the housing market, driving up development costs for real estate projects, as fuel plays a crucial role in production and transportation.

- Change in VAT status of fertilizer – Fertilizer and pest control products VAT status to be changed from zero rated to exempt. Previously fertilizer did not attract VAT. However the change in status will see increased production costs which will be passed onto the farmers, ultimately leading to an increase in the cost of food.

Farmers are already bracing for the Affordable Housing Levy that was introduced by the Affordable Housing Act, at a rate of 1.5% of their gross earnings. The cost will undoubtedly be passed onto the prices of food in the market. Farmers and landlords will have to log into i-tax to make the payments.

- Affordable Housing Levy – sneakily introduced by the Government when the Affordable Housing Act was passed earlier this year.

The KRA has since issued letters to all landlords in the Country inviting them for seminars for sensitization of the contents of the Act. The Affordable Housing Act will see a 1.5% levy on gross annual and monthly rental incomes as well as income derived from farming.

- Tax invoices by business owners – The bill carries on from the Finance Act, 2023 which added Section 23A into the Tax Procedures Act, to empower the Commissioner to establish an electronic system for the issuance of electronic tax invoices. The new bill now clarifies that this system will be facilitated by the eTIMS platform (Tax Invoice Management System.)

Taxpayers carrying on businesses in Kenya are required to issue electronic tax invoices and maintain records of their stocks in the system.

The move will make it mandatory for business owners to add VAT on all products they sell that fetch VAT. This may see higher prices as is already being witnessed when purchasing electronic goods online.

- 16% VAT on gaming and betting – The VAT status of gaming and betting will be changed from zero duty to exempt. This effectively means that the cost of betting, playing lotteries will increase, and the winnings will also be taxed higher. According to Deloitte, the purpose or aim is to regulate the consumption of the services and discourage its negative impacts.

- High taxes on equipment purchased by Local Film Producers – The Bill proposes a 16% VAT on the goods, equipment purchased by film producers whether locally or internationally.

The move will discourage investment into the burgeoning local film industry, which will in turn increase the costs of production for our local content creators.

- Increased costs to the tourism sector – In a bid to boost the tourism, to help it bounce back from the effects of the covid-19 pandemic, the Finance Act, 2023 had introduced exemptions to the taxable goods for direct and exclusive use for the construction of tourism facilities, recreational parks of fifty acres or more, convention and conference facilities upon recommendation by the Cabinet Secretary responsible for matters relating to recreational parks.

This Bill deletes this provision. The move will have a direct impact on tourism costs, especially with the creation of recreational parks, driving up the costs of these services.

- Increased costs for specialized health care – One of the gains of the Finance Act, 2023 was zero rating the construction and equipping of materials of specialized health care facilities such as cancer centers, or Clinics for Diabetes.

This Bill aims to delete this provision, which could lead to the costs of establishing and running such clinics and centers passed on to the specialized care which patients desperately need. In turn, this could continue to force Kenyans to seek cheaper specialized care abroad (India).

Conclusion

We’re preparing a Constitutional Petition to strike down features of this Bill as being unconstitutional & we are ready to file the second the assented bill is gazetted. We may be late to the party but we’ll do our best to make sure the party never stops!

The writer is a legal expert at Elkana Mogaka & Associates Advocates.